Headlines

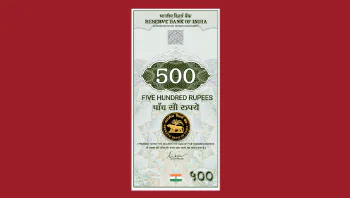

Central Bank Digital Currency, CBDC digital rupee would give a ‘big boost to the digital economy. Finance Minister had indicated that technologies such as blockchain would be used by the Reserve Bank of India to issue the currency, starting 2022-23. The Reserve Bank had, in July 2021, indicated that it would soon begin work on the ‘phased implementation’ of the CBDC.

Digital Rupee or Digital Mudra will change the entire scenario of the Indian economy. It will reduce the heavy transaction cost & available 24×7 globally. Apart from that it is valuable & checks other advantages below.

CBDC Digital Rupee‘s Security

Digital Rupees transactions are irreversible once authorised. This offers exceptional protection against fraud compared to fiat currencies, which are less secure due to the personal information required to make transactions and the potential for chargebacks. Digital currencies are empowered by blockchain technology, making them virtually impossible to counterfeit or duplicate

Fast, Mobile Payments Online

Sure, no transaction is faster than cash over the counter, but fiat currencies have their limits. When you’re sending money internationally, for example, a payment with fiat currency can take days or even weeks to process, particularly if the payment is thousands of dollars or larger. Digital currency payments, by contrast, are not only easy to make online via mobile devices but also functionally the same regardless of the amount or distance.

Peer-to-Peer Transactions

We’ve already mentioned that digital currencies are part of CBDC meaning you don’t need the resources of a third party like a bank or credit company to manage them, but this also means your transactions are directly peer-to-peer. Therefore, no third parties are necessary to guarantee the transaction.

Minimal Fees

Because CBDC digital rupee fees are peer-to-peer, you’ll encounter fewer, if any fees when transferring funds. The networking structure made possible by blockchain technology eliminates the need for intermediary institutions to facilitate transactions. Not only will you pay less in fees than you would if you were transferring fiat currencies, but you’ll also find it easy to monitor the process and keep track of your funds.

Discrete & Confidential

With fiat currency, much of your financial history is documented and handled by third parties, such as credit reporting agencies, banks, collectors, and marketers. With digital rupees, that’s not the case. The transaction history of the coin is what is recorded and stored, not the spender.

Safer for Merchants

CBDC Digital rupees transactions are validated in seconds. For merchants, this means a reduced risk of bounced checks or attempted chargebacks. Once a transaction is written in the blockchain, it cannot be withdrawn or reversed, offering enhanced security for businesses. Indeed, a growing number of merchants see digital currency as the future and are working to conduct more of their business with it.

A digital currency for merchants, backed by merchants’ goods and services

What is CBDC?

Central Bank Digital Currency is an institution, which will handle India’s digital currency system?

Who is handling CBDC in India?

Reserve Bank of India is handling & building policy for Central Bank Digital Currency.

When the CBDC digital ruppes will launch?

As per the budget speech by the Finance Minister of India. It will likely launch till March 2023.

Who is the head of CBDC now?

Right now Reserve Bank of India is the handling Central Bank Digital Currency department and the RBI governor is heading the department now.

Who can apply for the Digital rupees franchise?

Right now there is no clarity about the functions of Digital Rupees. Being a centralized agency, RBI will not distribute the Digital Rupees franchiee. Maybe all banks can be channel partners of RBI in digital mudra plateform.