Headlines

HSBC is a single multinational bank that is participating CBDC HSBC digital rupees pilot project. It is a foreign national bank, that expressed interest in CBDC digital rupees retail pilot project.

As you know that RBI will launch digital rupees online and HSBC will launch a separate HSBC Digital Rupee wallet because it will be India’s first digital currency which will be issued by official sources.

HSBC knows the importance of the Digital world and blockchain and they will never miss this opportunity to encash. They know that digital rupees will help them to reduce the branch load and cash process, which is a liability & they are spending too much money on it.

Because of digital mudra, HSBC can reduce the ATMs, branches & Cash chest process. Which will save money also.

What is the HSBC Digital Rupee wallet?

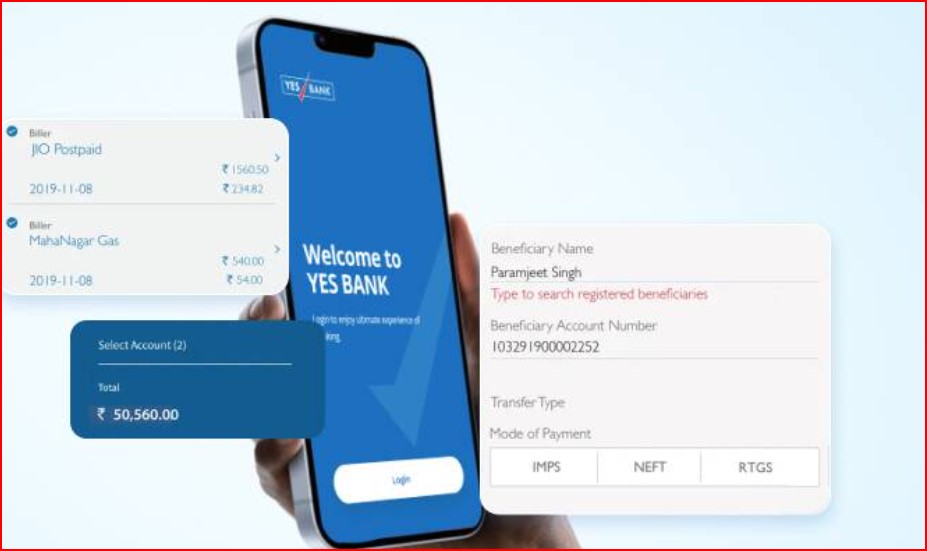

After issuing the CBDC digital rupees, all the institutions like HSBC will launch an HSBC Digital rupee wallet which will hold your all-crypto rupees like a traditional wallet. Crypto rupees will be a digital virtual rupee and it will be treated as legal tender in India.

How will it work?

HSBC Digital Rupees wallet will have a unique crypto address, which you will share with others to receive digital rupees online. Only the central bank or CBDC will have the entire transaction information. It will be fast, and secure with a global reach.

Is HSBC’s digital rupee wallet safe?

All transactions by HSBC digital wallet will be safe and secure but if your mobile phone will be hacked or you will share your HSBC digital rupee wallet secret key with others. Your balance may “0” within a minute.

Are there any transaction charges on HSBC digital rupee wallet?

Right now, several wallet companies are charging some transaction charges on crypto transactions, which is commission or slippage. Yes, HSBC can change yearly digital wallet charges or transaction charges or merchant fees.

How to register in HSBC DIgital Crypto rupee wallet?

RBI digital rupee is a new concept and right now all the financial institutions are understanding the process. As per the standard crypto wallet process. You have to download the RBI or bank’s digital rupees wallet from Google Play or the Apple store.

After downloading, you have to enter a few basic details like KYC, email, mobile number and secret key. After entering all data, the application will send one email to your account along with OTP on mobile.

Once you will enter both OTP (Email and Mobile). You will register as a user in your wallet. Now enter your bank account/UPI details for transactions.

Digital rupees are really a revolutionary product for RBI & govt of India because RBI is spending lakhs of crore rupees to print, mint and circulation. On average Reserve bank of India is paying up to rs 20 rupees for 100 to 2000 rupees per note for printing.

Apart from the RBI, the HSBC Bank is spending lots of crore in sorting, feeding ATMs and transactions. They will also save money.

HSBC will get maximum benefits from digitalization because they are the first multinational foreign bank which is authorized for CBDC digital rupees pilot project in India,

How can download HSBC digital rupee wallet download?

HSBC Bank is associated with the CBDC digital rupees pilot project and they are the wholesaler of digital rupees. Soon they will provide the CBDC HSBC Digital Rupee wallet to download.

You can click here to download HSBC digital rupee app.

Is HSBC authorized for e ₹ transactions?

Yes, in the CBDC pilot project, HSBC is authorized for digital currency transactions in India.

How can download the HSBC e-rupee wallet app?

HSBC is to launch its digital currency app for Indian, NRI and foreign nationals soon. Click here to know more and download the HSBC Digital currency wallet app.